The bad news is everywhere but I would like to convey some of the positive aspects that we are likely to experience during/post corona crisis.

Right now, we are experiencing four things;

- The biggest pandemic in last the 100 years,

- The biggest crash in oil which the world has ever seen,

- A contraction of the economy, the worst we have seen in last 100 years or 80 years,

- The biggest central bank intervention on a collective basis the world has ever seen.

The virus is less deadly but more contagious. As per April 30 Data, 33,610 COVID 19 cases were recorded, 8,373 have recovered while 1,075 have succumbed. 78% of the patients who’ve died had co-morbid conditions, more than half of the deaths have been among patients over 60 years of age, and recovery rate of Covid-19 patients has improved to nearly 25.2%, from about 13% a fortnight ago.

Since this is a medical cum financial crisis, it will be difficult to say markets and economy have bottomed out till such time we find a medical solution, which allows economic activity to resume on normalcy.

Here are five big ways India will benefit the most due to ‘Covid-19′

1. Cheaper oil due to The Great Oil Crash

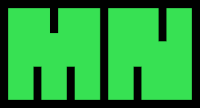

Crude oil is not just a commodity, it’s a part of your life. Transportation, factories, paints, aviation, tyres, etc all these industries use crude as raw materials. Think of it, India fulfills almost 85% of its oil requirements through imports of Brent crude, and due to lesser demand and the shutdown process, oil demand hit rock bottom, and oil price crashed. India spends billions of dollars every year to import crude on the current price. Brent crude price crashed to $26 from $68 dollar a barrel. Every dollar drop gives India advantage of $1.5 billion. So, India’s oil import bill may halve to $62 billion from $128 billion if the current crude price holds. Net profit for India would be around $66 billion. This hell lot of money can be spent on economic recovery. (See detailed analysis here)

2. $9 billion expected fund infusion in Indian financial market

Most of you might not be aware but On April 1, 2020, India entered into a new regime on foreign limits where it increased the foreign portfolio investment (FPI) limits to sector foreign limits. Which means, they have decided to treat sectoral limits as the foreign portfolio investor (FPI) investment limits. Any company which wanted a lower limit had to pass a separate resolution. Essentially, there are two large index providers MSCI and FTSE on whose indices people build their portfolios to outperform or passive funds track those indices to make the investments.

MSCI and FTSE have decided to increase India’s weight in their respective global indices.

MSCI India’s weight in EM is expected to rise by 55 basis points and India’s foreign inclusion factor to rise from 0.39 to 0.42 as a result of rebalancing and change in foreign investment limits. According to Morgan Stanley’s report, Indian stocks are expected to see an inflow of more than $7 billion (Passive inflows of $1.3 billion and active inflows of $5.7 billion) in the Indian market and India’s free-float market cap would increase from $356 billion to $385 billion.

After MSCI, FTSE Russell has also proposed to increase India’s weight on its global indices, which are tracked by funds with billions of dollars in the corpus. The move could increase India’s weight on the widely-tracked emerging market (EM) indices by as much as 156 basis points (bps). This could result in $2 billion of passive inflows into the Indian markets.

So $7 bn + $2 bn = $9 bn

(See detailed analysis here)

3. Global Reputation:

“One has sent the virus, the other is sending hydroxychloroquine tablets.”

Till now, you must be aware that Hydroxychloroquine has been identified by the US Food and Drug Administration as a possible treatment for the COVID-19.

India is supplying hydroxychloroquine to Zambia, Dominican Republic, Madagascar, Uganda, Burkina Faso, Niger, Mali Congo, Egypt, Armenia, Kazakhstan, Ecuador, Jamaica, Syria, Ukraine, Chad, Zimbabwe, France, Jordan, Kenya, Netherlands, Nigeria, Oman and Peru, Philippines, Russia, Slovenia, South Africa, Sri Lanka, Tanzania, United Arab Emirates, Uzbekistan, Uruguay, Columbia, Algeria Bahamas, Mauritius, and the United Kingdom etc.

The two of the oldest civilizations China and India are in the eyes of the world; one has sent the virus, the other is sending hydroxychloroquine tablets. This change in the perception about the image of India probably is also going to put more people to increase their active allocation to India and we could see higher FPI flows in the days to come courtesy MSCI and FDI index rebalancing.

In the month of March, Foreign portfolio investment (FPI) withdrew money from India but they took the money into those countries where interest rates are lower than India, where coronavirus patients are more than India and where GDP growth rate is negative even though in India, it is likely to be moderately positive.

These funds will be coming back soon.

4. Clean Air and lesser Covid 19 mortality rate

There are countless downsides to the world’s getting walloped by the coronavirus and being put under severe lockdown. But here in some of the most polluted cities on earth, where many people routinely wear face masks to filter out the filth, something rare and wonderful has emerged: a pure blue sky. All are stunned by how blue the sky really is as a strict lockdown cuts back drastically on air pollution.

A few days back, Delhi recorded a pollution reading of 38 on the Air Quality Index, about as good as anywhere in the world and stunning to Delhiites who have become steeled to a reading of 150 AQI — what a day!

With a 3.3% mortality rate, India also has one of the lowest Covid infection rates in the world.

For those of us who live in Indian cities, you and I are at a far greater risk of dying from a road accident or from air pollution than we are from Covid-19. In fact, the risk of us dying from road accidents or from air pollution in an Indian city is at least four times higher than the risk of us dying from Covid 19.

Thomas Bayes created a pathbreaking theorem that can be used to rationally think about the risks around Covid-19. Applying Bayes’ Theorem shows that the risk of us dying from road accidents or air pollution in an Indian city is at least four times higher than the risk of us dying from Covid. Hence a rational investor like us cannot help being massively bullish on high-quality Indian stocks.

Some results of after applying Bayes’ Theorem

- Even if one has symptoms of cough and cold, the chances of having Covid-19 in India is only 5%.

- Without symptoms (of cough and cold) the chances of being infected by Covid-19 in India falls to 0.42%.

- Even if you do have symptoms of cough and cold, the chances of not having Covid-19 are 95%.

The chances of you not having Covid-19 and not having symptoms are very high at 99.58 %. Finally, the probability of an Indian citizen having Covid-19 is 0.77%. That’s too low.

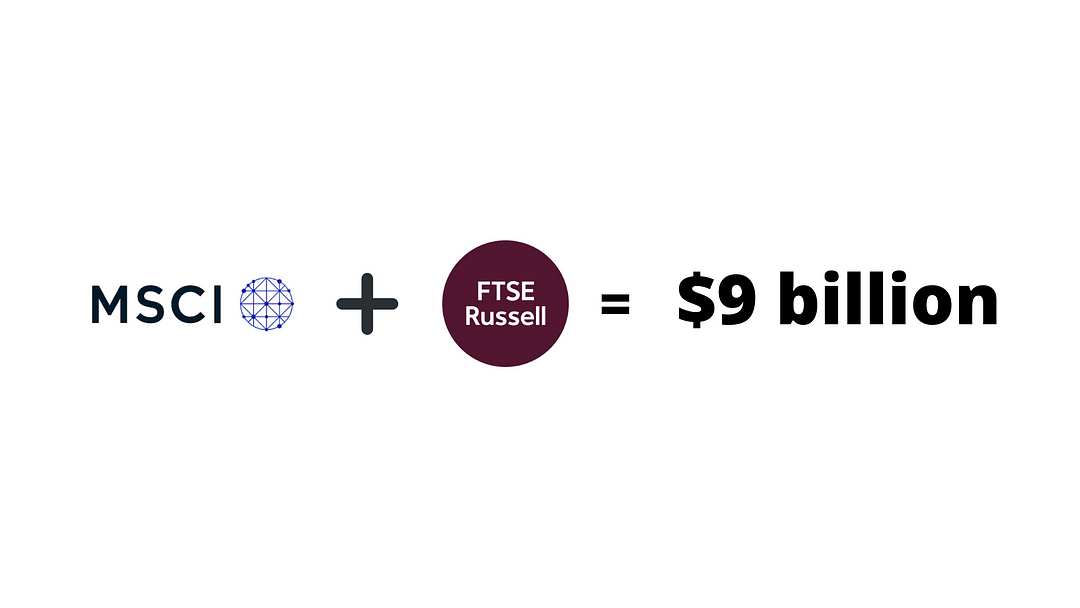

5. Time Travel in the Stock Market

- Largecaps are now available at 2017 valuations

- Midcaps are now available at 2014 valuations

- Smallcaps are now available at 2011 valuations

Most of the good Mutual funds have delivered more than 100% returns post-crisis.

So, this could also be a good time to buy your favorite stock/MF and build your wealth in the long term.

Also read: Top 10 Mutual Funds to Invest Amidst Corona Crisis

Today, the market is not discounting benefits of lower oil prices, lower trade deficit with the world, better potential capital flows and supply chain diversification but tomorrow, when there is a medical solution and there is no uncertainty, markets will start discounting those positives and this is the hope at which foreigners will be looking to invest in India. Between this hope and fear, the certainty and uncertainty, the market is trying to find a balance and which is why we have seen extreme volatility. Since this is a medical crisis, it will be difficult to say markets and economies have bottomed out till such time we find a medical solution, which allows economic activity to resume on normalcy.

If we go by IMF projections, they have cut down the calendar year 2020 target GDP growth to 1.9% but in the same way, they have increased India’s GDP growth target to 7% plus in CY2021.

For more articles like this, Join Free Marketnotes telegram channel

Join here

I hope for the best!

Akshay Seth

Research Analyst (SEBI Regd.)

Linkedin | [email protected]