When it comes to understanding RBI’s measures and decoding it to layman terms, everybody tries to look for sources that can make them understand its ‘meaning’ and ‘why they should care’. For example, If an IT professional doesn’t know about recent REPO rate reduction and he/she will never know that his company can now borrow funds from at a cheaper rate.

RBI has recently taken several bolder steps that every Indian should ‘know’ and ‘Understand’. The central bank has taken these decisions for the welfare of its countrymen but if countrymen itself didn’t understand its significance then it holds no value to them.

Be it the Great Financial Crisis of 2008, the Asian Crisis of 1997, the Russian debt crisis of 1998, or 1987’s Black Monday. There is a big difference between the uncertainty we faced then and now. The scale and the severity of the financial crisis were difficult to predict in both the short and long run as it was unfolding.

Here, I am decoding 10 RBI’s Measures against Coronavirus Crisis that every Indian should ‘Know’ and ‘Understand’

- RBI cuts Repo Rate by 75 basis points to 4.4% (Lowest since 2001)

What is Repo Rate: Repo rate is simply the rate at which the RBI lends money to commercial banks in the event of any shortfall of funds.

Effect: If banks borrow money from RBI at a cheaper rate then they pass this benefit to normal people or corporates and lend money at a cheaper rate so that more people/companies can afford to take the loan from the bank and boost the productivity.

The liquidity has to be deployed in investment-grade corporate bonds, commercial paper, and non-convertible debentures over and above the outstanding level of their investments in these bonds as on March 27, 2020.

2. TLTRO (Targeted Long Term Repo Operation):

The biggest problem for the RBI right now is the broken transmission chain. i.e. Banks are not passing the benefits of cheaper repo rate to consumers/corporates or simply they are not reducing the lending rate. Banks have simple explanation for this mismatch. They claim that they borrow from the RBI on an overnight basis. And RBI’s interest rate is only applicable to these overnight loans. Unfortunately, most bank loans last many years (think the house and car loans). And banks contest that they have to be more judicious when they cut rates alongside RBI because who knows what could possibly transpire in 8 or 10 years, they are right.

So sometimes, it can so happen that no matter what RBI does with its overnight lending rates (Repo Rate), long term bank rates remain stable. And this is a big problem. Especially when large corporates want to borrow at the cheapest rates available.

Solution: TLTRO (Targeted Long Term Repo Operation):

As per TLTRO, RBI is now offering loans (of up to 1 lakh crores) at overnight rates (of 4.4%) with long repayment periods of up to 3 years. Means, long term loans at ridiculously low-interest rates. Problem solved!

RBI wants to make sure corporate get to borrow at the cheapest rates available. So. It’s now forcing banks to use these funds to invest in corporate bonds.

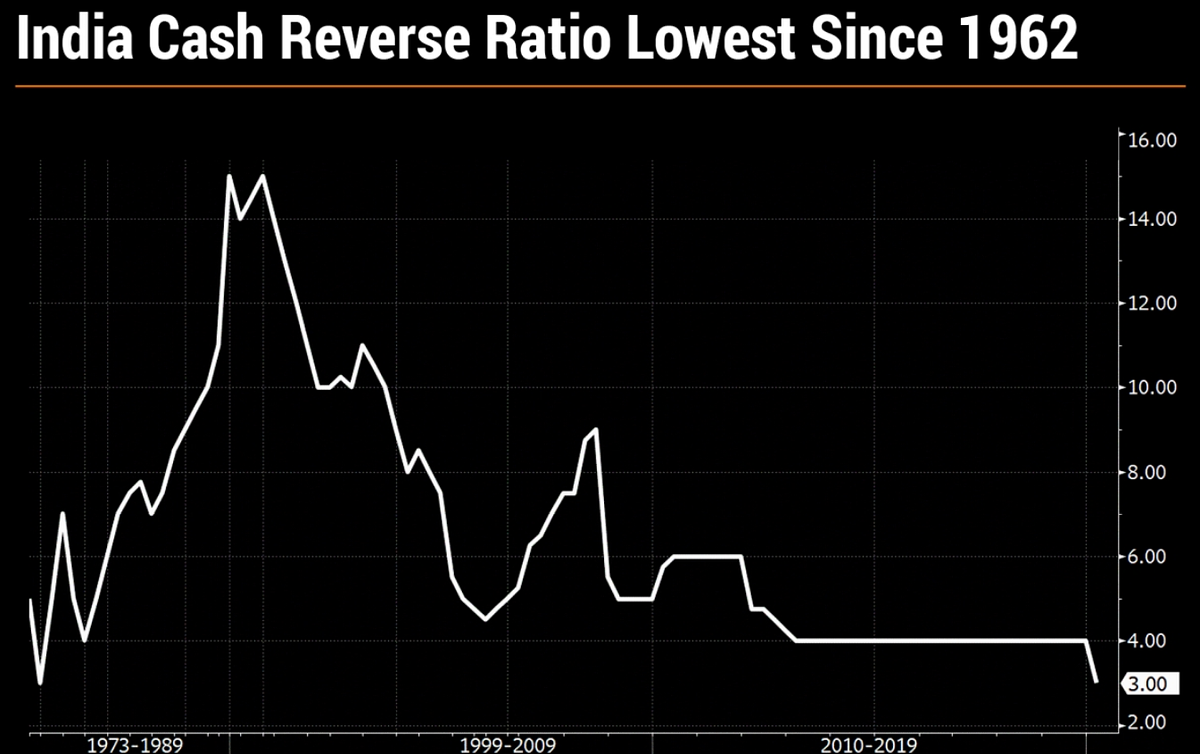

3. Cash Reserve Ratio (CRR ) of all banks to be reduced to 3% from 4%(Lowest since 1962)

Banks take deposits from you, put some necessary amount aside (18.25% as SLR and 3% as CRR) and try to lend the rest of the money to the borrowers so that they can charge them interest (more than they give interest to its depositors) and make some profits. So, Cash Reserve Ratio (CRR) is a specified minimum fraction of the total deposits of customers, which commercial banks have to hold as reserves either in cash or as deposits with the RBI.

RBI has decreased CRR to 3% from 4%. That would mean, banks could use this sum to lend and create more loans and an additional 1.37 lakh crore is now floating in the banking ecosystem. One more thing, Previously they were also expected to set aside 90% of the 4% cash reserve requirement on a daily basis which is now 80% of the 4% requirement every day. That would offer banks more leeway to lend.

4. Marginal Standing Facility (Changed to 3% from 2% of SLR)

What is MSF: Marginal standing facility (MSF) is a window for banks to borrow from the Reserve Bank of India in an emergency situation when inter-bank liquidity dries up completely. The Marginal standing facility is a scheme launched by RBI while reforming the monetary policy in 2011–12.

Under the MSF facility, In times of stress, banks can dip into their mandated pool of government securities or the ‘statutory liquidity ratio’ to borrow from the RBI’s marginal standing facility. Earlier banks could use up to 2% points of their SLR for such borrowings. This has now been increased to 3% points.

The RBI extended this limit to 3% of SLR from the existing 2% until June 30, to provide comfort to the banks. The marginal standing facility rate would now stand at 4.65% with a spread of 25 bps over the repo rate.

These three measures relating to TLTRO, CRR and MSF will inject a total liquidity of Rs 3.74 lakh crore to the system.

5. Ways and Means Advances (WMA)

What is WMA: The Reserve Bank of India (RBI) gives temporary loan facilities to the central and state governments. This loan facility is called Ways and Means Advances (WMA). This scheme was introduced in 1997 to meet mismatches in the receipts and payments of the government.

Under this scheme, a government can avail itself of immediate cash from the RBI as a loan at the existing repo rate. However, the loan repayment has to be done within 90 days. If the WMA exceeds 90 days, it would be treated as an overdraft (interest rate on overdrafts is 2 percentage points more than the repo rate).

Recent changes: RBI has increased the WMA limit by 30% from the existing limit for all states and union territories. The Central government has increased the ceiling on WMA by 60% to 1.20 lakh crore (from 75,000 crores last year) to tide over the cash flow mismatch in FY21 expected from higher spending to combat the spread of COVID-19. The revised limits will come into force with effect from April 1, 2020, and will be valid till September 30, 2020.

Note: The hike in WMA limit is pending submission of the final recommendation of an Advisory Committee, headed by Sudhir Shrivastava, set up by the RBI to review the WMA limits for state governments and Union Territories.

6. Extension Of Realisation Period Of Export Proceeds

Present Provision: The value of the goods or software exports made by exporters is required to be realised fully and repatriated to the country within nine months from the date of exports.

New Provision: For exports made up to or on July 31, RBI extended the deadline for realisation and repatriation period of export proceeds to 15 months from nine months at present.

The measure will enable exporters to realise their receipts, especially from COVID-19 affected countries, within the extended period. It will also provide greater flexibility to exporters to negotiate future export contracts with buyers abroad.

7. EMI moratorium

RBI announced a moratorium of three months on all term loan and credit card instalments due between 1 March and 31 May 2020. This moratorium also covered credit card dues.

The announcement gathered a lot of interest as, initially, many believed that loan EMIs and credit card dues had been waived for three months. But that’s not true.

RBI has clearly mentioned that during the period of moratorium, interest will continue to be levied on the outstanding portion of the term loan.

Banks are, however, charging interest not only on the outstanding loan amount but also on the interest amount that will accrue on the outstanding loan during the period of the moratorium. After the moratorium ends, the interest accrued during the period will get added to the principal outstanding and, hence, increase the overall loan amount. When the overall loan amount increases, so will the interest payable on it. This additional interest will be payable through the tenure of the loan.

8. No Counter-Cyclical Capital Buffer (CCCB) for one year

What is CCCB: “With the CCCB, banks are required to set aside a higher portion of their capital during good times when loans are growing rapidly so that the capital can be released and used during bad times when there’s distress in the economy.”

As per RBI, Counter-cyclical buffer for banks will not be applicable for a period of one year and this can help banks keep up the credit flow in the economy. The framework on the counter-cyclical capital buffer is scheduled to be activated as when the situation arises.

RBI is also deploying unusual weapons to fight the economic fallouts of the pandemic. Following Basel-III norms, central banks specify certain capital adequacy norms for banks in a country. Like Capital Adequacy, the CCCB is also a part of such norms and is calculated as a fixed percentage of a bank’s risk-weighted loan book.

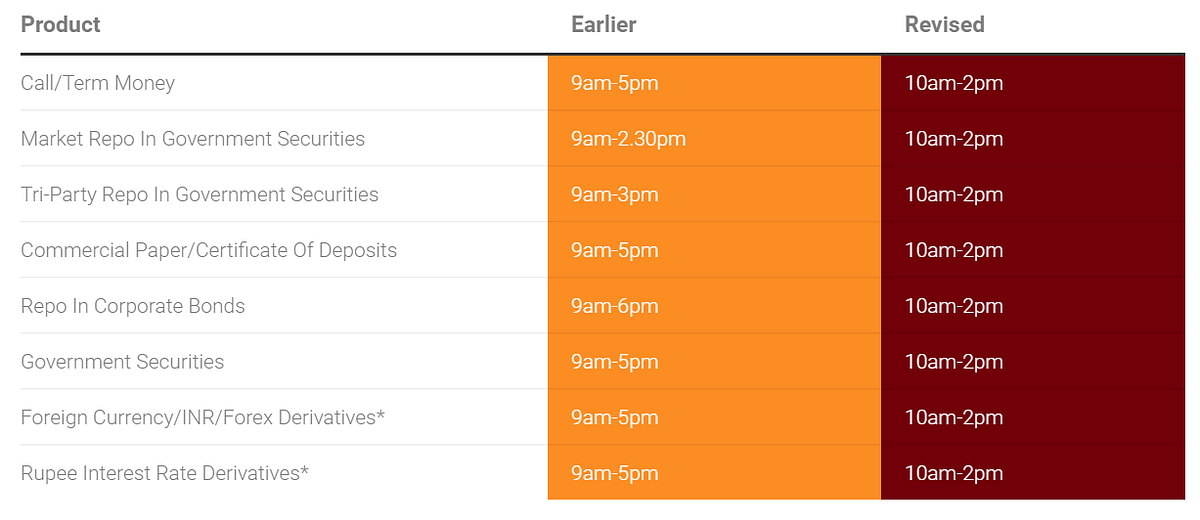

9. Shortens Forex, Money Market Trading Hours

The Reserve Bank of India has decided to shorten trading hours for foreign exchange and money markets products, in light of challenges posed by lockdowns imposed to curb the spread of Covid-19.The shortened hours, which will be in place from April 7–17, apply to products that do not trade on recognised exchanges.

In order to minimise these risks and to ensure that market participants maintain adequate checks and supervisory controls while optimising thin resources and ensuring the safety of personnel, it has been decided to revise trading hours for the various market. — RBI Press Release

10. Trade in Offshore Rupee Derivative Market

The Reserve Bank of India allowed offshore units of Indian banks to participate in the offshore rupee derivative market to curtail volatility in currency markets due to the Covid-19 pandemic. Banks will now be allowed to participate in the non-deliverable forward (NDF) market, which till now has primarily been dominated by offshore traders in the Indian foreign exchange market.

Hope this was informative.

Join Free Marketnotes telegram channel to get the best viral stories straight into your inbox: Join here

Akshay Seth

[email protected]

Linkedin